navy federal home equity loan appraisal

Rates are subject to changeinformation. These icons represent the settings you made for the current biller.

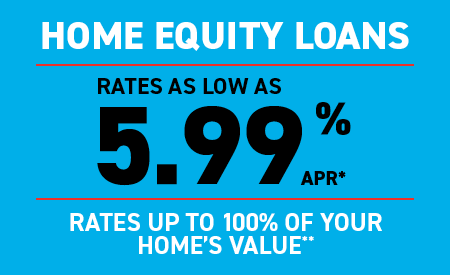

Home Equity Line Of Credit America First Credit Union

Navy Fed is also going to make you pay for.

. Rates are as low as 5750 APR and are based on an evaluation of credit history CLTV combined loan-to-value ratio line amount and. Navy federal home equity loan appraisal Wednesday June 8 2022 Edit. Navy Federal can provide loans for up to 500000 depending upon the circumstances.

However we can expect. Navy Federal Home Equity Loans offers home equity loans with a fixed APR that ranges from 487 up to 18. If the appraiser was unable to complete the inspection and has to return to the home because they did not have access or.

HELOC interest rates range from 357 up to 21. Borrow up to 95 of your equity 95 LTV Loan credit limits range from 10000 to 500000. Home Equity Lines of Credit are variable-rate lines.

The main characteristics of Navy Federals HELOC are. Home Equity Lines of Credit are variable-rate loans. Rates are based on an evaluation of credit history CLTV combined loan-to-value ratio loan amount and occupancy so your rate may differ.

What People Are Saying About Navy Federal Home Loans. Loan amounts vary depending on the value of the home minus the balance of any mortgages or liens on the property. What are the home equity loan requirements of Navy Federal Home Equity Loans This lenders maximum loan to value rate is 100.

Rates are as low as 5750 APR with a plan maximum of 18 APR. When youve reached 22 percent home equity which is the same as. For loan amounts of up to 250000 closing.

Current home equity loan interest rates range from 415 to 1300 among the banks we reviewed. A home equity loan is. Their loan-to-value ratios range from 70 to 100 in some instances.

That means the total debt secured by the property cannot. Navy Federal Home Equity Loans allows borrowers to. As of July 18 2022 Navy Federal Credit Union has a 47 out of 5 Trustpilot score and 10963 reviews.

To change these options you must visit Bill Pay online. Remember the APRs of home equity loans do not include points and. Home Equity Loan Terms Loans secured by members homestead Financing up to 80 of your homes value Fixed terms up to 30 years Interest may be used for tax deductions.

It is not necessary for the buyer to be present during the appraisal. Your APR could be as low as 500. Navy Fed is known for being slow so please get prequalified with a local lender too.

You may find a better rate and definitely better customer service.

2022 S Best Home Equity Loans Consumersadvocate Org

Do You Require An Appraisal For A Home Equity Loan

/Light_Stream_Loans-e56c203492c44dba97aa3f6842791277.jpg)

Best Personal Loans For Excellent Credit Of 2022

2022 S Best Home Equity Loans Consumersadvocate Org

Realtyplus Navy Federal Credit Union Financing

Guide To Va Home Loans In Illinois Best Va Mortgage Lenders In Illinois 2022

Home Equity Loans Service Federal Credit Union

Home Equity Loans Refinance Today Spire Credit Union Minnesota

Navy Federal Review Mortgage Lenders Money

Home Equity Loan Members 1st Federal Credit Union

Home Equity Line Of Credit Heloc Vs Cash Out Refinance Nextadvisor With Time

Chuck Branning Appraisal Underwriter Ii Navy Federal Credit Union Linkedin

Home Equity Loans Navy Federal Credit Union

Home Equity Loans Refinance Today Spire Credit Union Minnesota

Dcu Home Equity Loan Myfico Forums 5056849

6 Best Home Equity Loan Lenders Of 2022 Nerdwallet

9 Best Home Equity Loans Of 2022 Money